“In college, I earned over $10,000 in tuition fees selling phone cases on eBay – that was my first e-commerce income.” Brayden’s story reveals the limitless potential of cross-border e-commerce. Based on his deep coverage of 30+ global e-commerce platforms, this article uncovers the secrets behind the most beginner-friendly, highest-potential, and fastest-growing platforms.

The Platform Pyramid: Essential Classification for Beginners

Level 1: Beginner-Friendly Platforms

1. eBay Top 10 globally visited e-commerce platform, ideal for electronics and collectibles. Low barriers to entry – perfect for selling used items while learning operations. Pro Tip: Start with niche products like sports cards for low-risk experimentation.

2. Etsy Handmade creative product paradise where users pay premiums for unique designs. Simple backend operations, highly beginner-friendly. Caveat: Build owned traffic early (email/social media) to reduce platform reliance.

3. Shopee 380M+ users across Southeast Asia; light/small products benefit from low shipping costs. Market Data: SEA e-commerce reached $143.7B in 2023, projected to exceed $330B by 2028.

4. Mercari C2C secondhand marketplace with transparent fees and no monthly/listing charges. Entry Strategy: Start by selling unused clothing to test the US market and learn platform rules.

Level 2: High-Ceiling Growth Platforms

5. Amazon World’s largest e-commerce platform that incubated billion-dollar brands like Anker. Cost Structure: $39.99/month + 8-15% category commissions + required ad spend. FlashID Application: Isolated browser environments enable independent category testing while preventing account association.

6. TikTok Shop US GMV exceeded $15B in 2024 – explosive growth through short-form video commerce. Success Story: BetterAlt achieved over $10M in sales solely through TikTok. FlashID Advantage: Multi-account management for rapid content strategy testing – window sync completes 3-channel operations in 10 minutes.

7. Mercado Libre Latin America’s largest e-commerce platform with Mexican consumer habits similar to US shoppers. Growth Metrics: Yiwu merchants report 200% YoY increase in Latin American clients. FlashID Value: Multi-account management across different Latin American sites with automated localization optimization.

8. Fyndiq Sweden-based Nordic platform with 50-60% profit margins. Market Characteristics: 25M population with spending power equivalent to 150M Asians; minimal Chinese seller presence. FlashID Enablement: Cloud phone management for multiple Nordic countries enables precise localization testing.

Level 3: Pro Player Vertical Markets

9. Russian E-commerce Triumvirate

- Ozon: “Amazon of Russia” with 70M+ native users

- Wildberries: Fashion category leader with unique pickup point network

- Yandex Market: Search traffic gateway with price comparison functionality FlashID Solution: Three-platform independent environments mitigate policy volatility risks.

10. Germanic/French Systems

- Cdiscount (France): 30%+ design premium

- Otto (Germany): Mid-to-high positioning with high AOV FlashID Implementation: Synchronized German/French account management with cross-platform data synchronization.

11. Alibaba Ecosystem in SEA

- Lazada: 6-country coverage with greater seller autonomy

- Tokopedia: Indonesia’s largest single market with strong community features FlashID Application: Multi-language account isolation with parallel localization strategy testing.

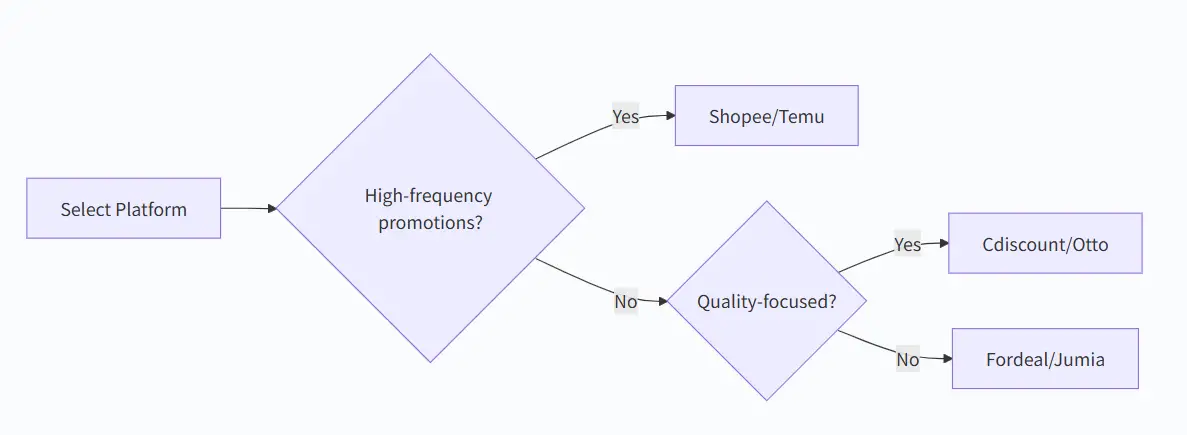

Beginner’s Survival Guide: 7 Principles for Platform Selection

1. Threshold Gradient System

| Platform Type | Examples | Entry Difficulty | Capital Need |

|---|---|---|---|

| Practice Type | eBay/Mercari | ★☆☆☆☆ | <$800 |

| Growth Type | Etsy/Shopee | ★★☆☆☆ | $1,500-$5K |

| Professional | Amazon/Target | ★★★☆☆ | >$8K |

| Blue Ocean | Fordeal/Jumia | ★★☆☆☆ | $3K-$6K |

2. Language Barrier Breakthrough

AI translation is no longer a barrier:

- Solution 1: Real-time browser extensions (DeepL)

- Solution 2: FlashID multi-language account management with automatic content localization

- Solution 3: Hire localization teams (reserve 30% budget)

3. Competitive Balance Framework

Brayden’s Strategic Pivot: From Platform Seller to Brand Builder

“Over-reliance on a single platform is extremely dangerous!” Brayden’s lesson after experiencing Amazon store suspension:

- Independent Stores Are the Ultimate Goal: Dedicate 50% of effort to brand building

- Multi-platform Distribution Strategy: Amazon (traffic) + Etsy (profit) + DTC (asset)

- FlashID Synergy Value:

- B2C platform testing: Isolated environments for competitive analysis

- Social matrix: 5+ synchronized accounts for brand storytelling

- Automated data sync: RPA completes full-platform reports in 30 minutes

Future Growth Hotspots: 3 Blue Oceans

Nordic Fyndiq Market

- Population: 26M (spending power ≈ 150M Asians)

- Profit Margin: 50-60% (Amazon average: 25%)

- Entry Barrier: VAT registration + EU compliance

- FlashID Action Plan:

- Cloud phone simulation of Nordic user behavior

- A/B testing 3 localization strategies

- Window-sync management across 4 Nordic countries

Latin American Duopoly

| Platform | Coverage Countries | Advantage Categories | Profit Margin |

|---|---|---|---|

| Mercado Libre | Brazil/Mexico | Home/3C | 35%+ |

| Falabella | Chile/Peru | Fashion/Home | 40%+ |

- FlashID Strategy:

- Multi-account isolation for Arabic/Spanish

- RPA-automated local ad optimization

- Cloud phone testing of Latin payment scenarios

Jumia African Market

- User Scale: 11-country coverage; 200M+ Nigerian users

- Growth Projection: 35%+ annual growth

- Key Challenge: Logistics infrastructure

- FlashID Solution:

- Mobile multi-account management (cloud phone)

- Logistics data crawler with automatic optimization

- Payment scenario simulation (40% cash transactions)

Tool Evolution: FlashID Integration for Platform Operations

1. Account Management Panorama

Desktop (FlashID Browser):

Amazon testing environment → Competitor SEO analysis

Etsy isolated environment → A/B testing thumbnails

Digital marketing accounts → Ad campaign isolation

Mobile (FlashID Cloud Phone):

Social media matrix → Automated content distribution

Payment testing → Local payment method optimization

Competitor monitoring → 24/7 real-time data collection

2. Automated Workflow Optimization

| Traditional Process | FlashID-Optimized | Time Saved |

|---|---|---|

| Cross-platform reporting | RPA sync across 10+ plat | 5 hrs/day |

| Multi-account operations | Window sync + automation | 3x efficiency |

| Competitor price scraping | Cloud phone automation | Real-time |

3. Risk Control Matrix

# Platform Association Risk Detection

def risk_detection(platform_list):

if len(platform_list) > 5:

for p in platform_list:

check_ip/browser_fingerprint(p)

check_payment_method(p)

check_user_behavior(p)

else:

safe_operation()

E-commerce Era Survival Rules

Brayden’s journey from eBay phone cases to Etsy top seller reveals three core trends:

- Platform-to-Brand Mindset Shift: Real moats lie in brand assets

- Multi-platform Capability Becomes Standard: FlashID empowers small sellers with enterprise-level operations

- Blue Ocean Opportunities Emerge: Nordic, Latin, and African markets await pioneers

As Brayden states: “From the painful lesson of Amazon suspension, I realized platform rules always outweigh product value, while multi-account isolation technology creates the strongest moat.”

Frequently Asked Questions (FAQ)

1. How much capital should beginners invest in cross-border e-commerce? Recommended progressive investment approach: Start with $800-$1,500 for eBay/Mercari, then increase to $5,000-$8,000 for category expansion. FlashID basic version (~$30/month) significantly reduces trial costs.

2. How to balance operations across multiple platforms? Apply the 80-20 rule: 80% focus on core platform (Amazon), 20% test emerging platforms. FlashID window sync manages 5+ platforms’ basic operations simultaneously.

3. What’s the fatal risk in cross-border e-commerce? Single-platform dependency. Ensure 30% of sales come from DTC stores. FlashID enables complete isolation between B2C testing and DTC accounts.

4. Are Nordic profit rates really 50-60%? Fyndiq data confirms 50-60% margins for designer home/creative products. Note EU VAT compliance requirements – FlashID automatically switches between different countries’ tax environments.

5. How to solve language barriers in emerging markets? Three-tier strategy: 1) Real-time browser extensions 2) FlashID multi-language account management 3) Hire local customer service ($1,200-$1,800/month).

6. What’s TikTok Shop’s core difference from traditional platforms? Content-as-product: Creative content triggers explosive algorithmic reach. FlashID cloud phones simulate different user group viewing behaviors to optimize publishing strategies.

7. Is the Russian market worth entering despite geopolitics? Opportunity exists: International brands’ withdrawal creates 30% market vacuum. FlashID fingerprint isolation prevents multi-platform association detection.

8. How to build sustainable revenue models?

Pyramid Model:

- Base: Budget entry-level products. (Temu/Joom)

- Middle: Premium products (Etsy/Fyndiq)

- Top: Brand premium (DTC + Amazon brand) FlashID data sync automatically optimizes inventory allocation across tiers.

9. Can FlashID solve payment association issues?

Completely. Its banking account isolation matches platform requirements:

- Amazon requires legal entity bank accounts

- Etsy accepts Payoneer

- DTC binds to Stripe/PayPal All payment information is stored independently.

10. Which markets should we prioritize in the next 3 years?

Top 3 growth markets:

- Vietnam (Supply chain shift + 5% GDP growth)

- Nigeria (Jumia coverage + 200M population)

- Sweden (Fyndiq platform + 50% margins) Early adoption with FlashID cloud phones secures first-mover advantages.

You May Also Like