Official website:https://vmcardio.com/zh

In cross-border business today, one thing kills growth faster than bad creatives: payment friction. Ad accounts get paused because a card fails. SaaS renewals bounce. Cloud servers shut down at midnight because the bank decided your risk profile “looks strange”.

Vmcard exists to solve exactly this layer of problems. It is an enterprise-level virtual Visa & Mastercard issuing platform designed for advertisers, e-commerce teams, SaaS power users and service providers who need stable, controllable, high-approval online payments instead of traditional bank card drama.

What is Vmcard?

Vmcard is a purely online virtual credit card platform. All cards are digital – no plastic, no trips to the bank.

Users can:

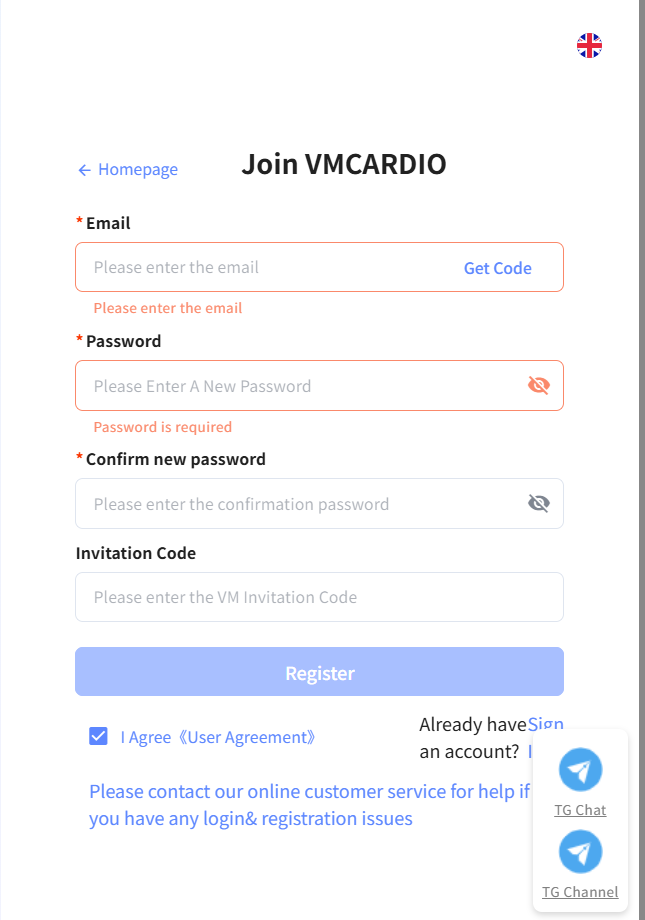

- Register an account online and complete a simple onboarding process.

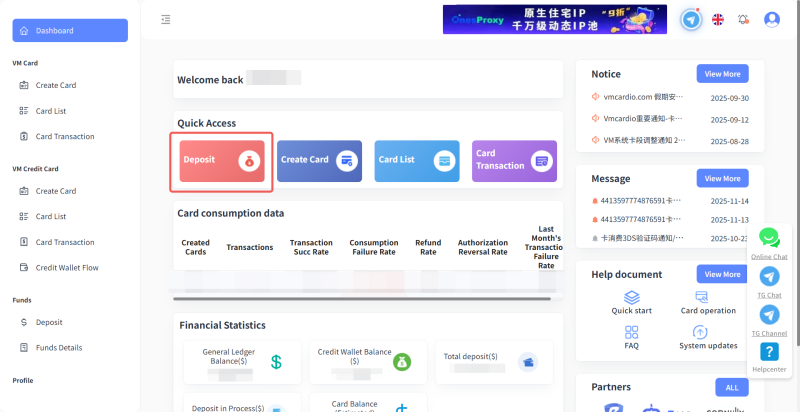

- Top up their main balance in real time,24/7.

- Issue multiple virtual Visa & Mastercard cards in a few clicks.

- Bind these cards to ad platforms, e-commerce sites, cloud services, subscriptions and digital tools around the world.

Vmcard is a “pay-only” product: it is built for spending (ads, tools, services, purchases), not for collecting payments. This focused design keeps the system simple, efficient and optimized for high-frequency transactions.

Core Features of Vmcard

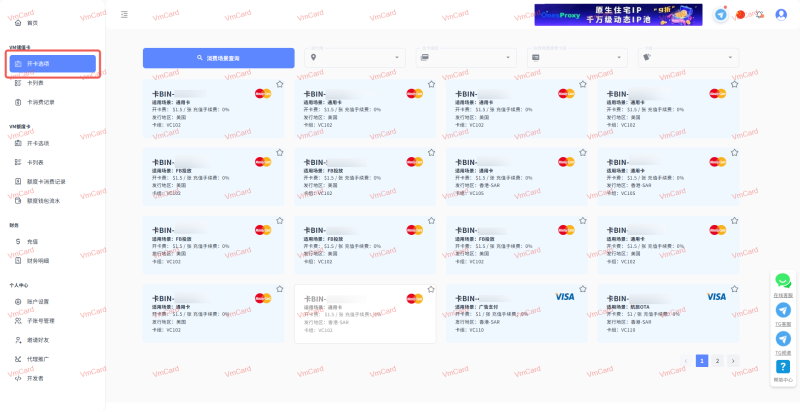

Multi-BIN virtual Visa & Mastercard

Vmcard provides a wide range of global card BINs optimized for cross-border payments. This helps improve authorization success rates on major platforms and reduces random declines caused by GEO or risk mismatches.

One balance, many cards

You top up once at the account level, then create as many virtual cards as your usage scenario requires. Each card can be named, labeled and separated by project, client, store or traffic source, making cost tracking and risk isolation much easier.

Real-time control and monitoring

In the Vmcard dashboard you can:

– Set custom limits for each card (per day, per month or per project).

– Freeze or close a card instantly when an account is no longer in use.

– View authorizations and settled transactions in real time.

– Quickly identify which card is tied to which ad account, store, SaaS tool or team.

24/7 instant recharge

Vmcard supports fast, around-the-clock funding. Whether your campaigns are scaling during peak hours or a server invoice hits at night, you can recharge your balance and keep everything running without waiting for banking hours.

Enterprise-ready structure and API

For teams and platforms, Vmcard offers:

– Batch card issuing functions for operating multiple accounts at scale.

– Role-based access, so finance, operations and management can each see the data they need.

– API integration, allowing platforms, agencies or tool providers to automate card issuing and lifecycle management inside their own systems.

Typical Use Cases

Vmcard is designed for real, high-frequency online operations, including:

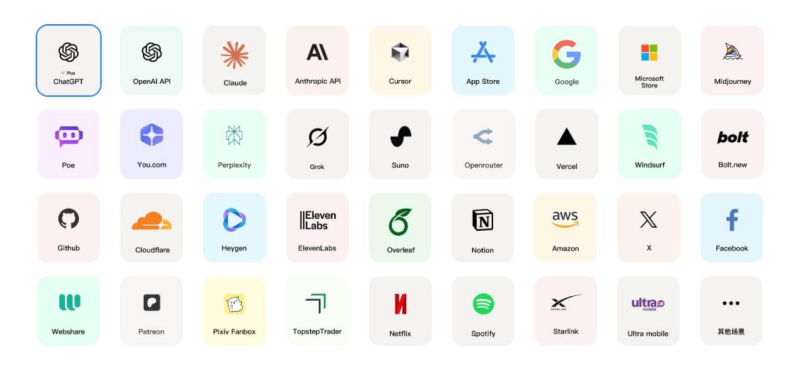

Digital advertising

Media buyers and agencies can bind Vmcard virtual cards to Facebook/Meta, TikTok, Google, and other ad platforms for stable, repeatable top-ups. Each ad account or group of accounts can have its own dedicated card, helping isolate risk and track ROI more clearly.

Cross-border e-commerce

Cross-border merchants can pay for marketplace fees, store subscriptions, third-party apps, logistics tools and more using cards that are accepted globally. Multiple stores or brands can each have a labeled card, simplifying reconciliation.

SaaS and AI tools

Teams relying on AI tools and SaaS—such as model subscriptions, productivity suites, analytics platforms or cloud automation—can centralize all these recurring payments on Vmcard. This avoids personal cards, messy invoices and sudden renewal failures.

Cloud services and infrastructure

For cloud servers, CDNs, domain registrars and other infrastructure providers, Vmcard offers a dedicated layer of payment control. If one project is shut down, its card can be paused immediately without affecting other running services.

Why Teams Choose Vmcard Over Traditional Cards

Traditional bank cards were never designed for “one person, many accounts” or “one company, many projects across multiple regions”. They typically:

– Limit the number of cards per entity.

– Trigger risk control on repeated online payments or high-frequency ad spending.

– React slowly when you need support or adjustments.

Vmcard flips this model: the platform is built from the ground up for digital teams managing multiple accounts, projects and tools. You are encouraged to create more cards, not fewer, because that is how you achieve cleaner cost structure and better risk isolation.

Who Vmcard Is For

Vmcard is ideal for:

– Advertising agencies and media buyers operating multiple ad accounts.

– Cross-border merchants managing several stores or brands.

– SaaS-heavy teams and AI tool users with many subscriptions.

– Service providers and platforms that need to embed virtual cards via API.

For all of these users, Vmcard is not just “another card”. It is the payment infrastructure behind their digital operations: stable, scalable and designed to grow with the number of accounts, projects and tools they manage every day.

You May Also Like